The GDIF Team Work With Over 270+ Banks, FIs, Funds And Alternative Financiers Across Multiple Geographies And Jurisdictions To Help Companies Access Finance Fast. We Have Product Specialists, From Cashew Nut Experts To Scrap Metal Gurus, Who Work Collaboratively Help Companies Grow Their Trade Lines Both Internationally And Domestically.

Our Team Of Experts Are Agnostic Of Finance Product Types And Will Look At Numerous Financing Options To Help Find The Best Solutions To Help You Grow Your Trade Flows. From Vanilla Trade Finance Facilities Or Export Finance Products Right Through To Complex Cross-Border Commodity Trade, Our 24/7 Team Are Here To Help You Grow.

We’re Often Regarded As A CFO Or FD, As Opposed To An Originator Or Broker Of Trade Finance. We Know You’re Busy Running The Business, And Our Dedicated Account Managers Work Around The Clock To Help Place You With Financing Structures As Quickly As Possible. We’re Your Partners In Trade And Work With The Majority Of Funders In Most Jurisdictions Around The World.

At Geo Decentralized Investment Funds, We Know Who The Decision Makers Are, The Key Influencers And Managers At Banks, Financial Institutions And Funds, So It’s Often Easier And Faster To Get To The Right Person Quickly And Speed Up Your Application. All At No Cost To You.We’re 100% Independent & Impartial: Working Only For Our Businesses Geo Decentralized Investment Funds Have No Ties With Any One Lender, So Can Be Flexible At Offering The Product That’s Right For You, Not An Off The Shelf Product That Inhibits Growth Or Limits Opportunities For Your Business, No Matter How Complex. Often The Financing Solution That Is Required Can Be Complex, And Our Job Is To Help You Find The Most Appropriate Trade Finance Solutions For Your Business.

Trade Financing Includes:

- Lending Facilities

- Issuing Letters Of Credit (LCs)

- Export Factoring (Companies Receive Funds Against Invoices Or Accounts Receivable)

- Forfaiting (Purchasing The Receivables Or Traded Goods From An Exporter)

- Export Credits (To Reduce Risks To Funders When Providing Trade Or Supply Chain Finance)

- Insurance (During Delivery And Shipping, Also Covers Currency Risk And Exposure)

The Benefits Of Trade Finance At GDIF

- Facilitates The Growth Of A Business Cash And Working Capital Are Key To The Success Of Any Business. Trade Finance Often Helps Make A Company’s Goods Or Receivables Work For Them, Freeing Up And Releasing Working Capital That Is Tied In Stock. Why Does This Help? You Can Suddenly Offer More Competitive Terms To Win Your Next Business, Not Be Tied By Late Payment Or Lengthy Delays Between Shipping An Order And Receiving Payment, Which Is Ultimately Good For Growth And Good For Your Customers. Trade Finance Is A Form Of Short To Medium Term Working Capital Solution Which Uses The Security Of The Stock Or Goods Being Exported / Imported As A Guarantee

- Increased Revenue Potential / Higher Margins Trade Finance Allows Buyers To Request Higher Volumes Of Stock Or Bigger Orders From Suppliers, Meaning Businesses Can Easily Benefit From Economies Of Scale And Bulk Discounts Off Volumes. The Margin Benefits Of Using Trade Finance To Grow A Business Can Help Win Competition And Increase Revenue. Trade Finance Can Also Help Strengthen The Relationship Between Buyers And Sellers, Increasing Profit Margins And Profits

- More Efficiency In Trades And Supply Chain Managing The Supply Chain Is So Important For Any Business. Trade And Supply Chain Finance Helps Ease Out Cash Constraints Or Cash Gaps, Whether It’s The Suppliers, Customers, Third Parties, Employees Or Providers, Trade Finance Can Help Ease And Release Working Capital From The Supply Chain

- Mitigates Risk From Suppliers Trade Financing Reduces Credit And Payment Risks Or Bad Debt Risk On Suppliers As The Funders Take Hold Over The Goods Being Traded. Trade Financing Focuses More On The Trade Than The Underlying Borrower (Not Balance Sheet Led), So Small Businesses With Small Balance Sheets Can Trade Larger Volumes More Easily And Work With Larger End Customers

- Diversify Your Supplier Network Working With Other International Players Allows Business Owners To Diversify Their Supplier Network Which Increases Competition And Drives Efficiency In Markets And Supply Chains

- Reduces Bankruptcy Risks Late Payments From Debtors, Bad Debts, Excess Stock And Demanding Creditors Can Have Detrimental Effects On A Business. External Financing Or Revolving Credit Facilities Can Ease This Pressure And Prevent An SME From Facing These Risks

Frequently Asked Questions

Why Is Trade Financing Important?

International Trade Accounts For Around 3% Of GDP, Employing Millions Of People Around The World. Some 90% Of Global Trade Is Reliant On Supply Chain And Trade Finance, Totalling USD $10 Tn A Year. Trade Finance Is A Form Of Cash Flow Lending Which Helps Finance Trade Flows, Global Supply Chains And Procurement Of Goods Both Domestically And Internationally.

What Does Trade Finance Include?

Trade Finance Includes The Following:

| – Bonds And Guarantees- Lending Facilities- Issuing Letters Of Credit (LCs)- Export Factoring (Companies Receive Funds Against Invoices Or Accounts Receivable)- Forfaiting (Purchasing The Receivables Or Traded Goods From An Exporter)- Receivables Financing, Invoice Factoring And Invoice Discounting- Export Credits (To Reduce Risks To Funders When Providing Trade Or Supply Chain Finance)- Insurance (During Delivery And Shipping, Also Covers Currency Risk And Exposure)- Supply Chain Finance- Foreign Exchange And Currency Products |

What Are The Methods Of Payment For Trade Finance

Cash Advances

As The Least Risky Product For The Seller, A Cash Advance Requires Payment To The Exporter Or Seller Before The Goods Or Services Have Been Shipped. Cash Advances Are Very Common With Lower Value Orders, And Helps Provide Exporters / Sellers With Up Front Cash To Ship The Goods, And No Risk Of Late Or No Payment.

Letters Of Credit (LCs)

Also Known As Documentary Credits Are Financial, Legally Binding Instruments, Issued By Banks Or Specialist Trade Finance Institutions, Which Pay The Exporter On Behalf Of The Buyer, If The Terms Specified In The LC Are Fulfilled.

An LC Requires An Importer And An Exporter, With An Issuing Bank And A Confirming (Or Advising) Bank Respectively. The Financiers And Their Creditworthiness Are Crucial For This Type Of Trade Finance: It Is Called Credit Enhancement – The Issuing And Confirming Bank Replace The Guarantee Of Payment From The Importer And Exporter. In This Section, And In Most Cases, We May Consider The Importer As The Buyer And The Exporter As The Seller.

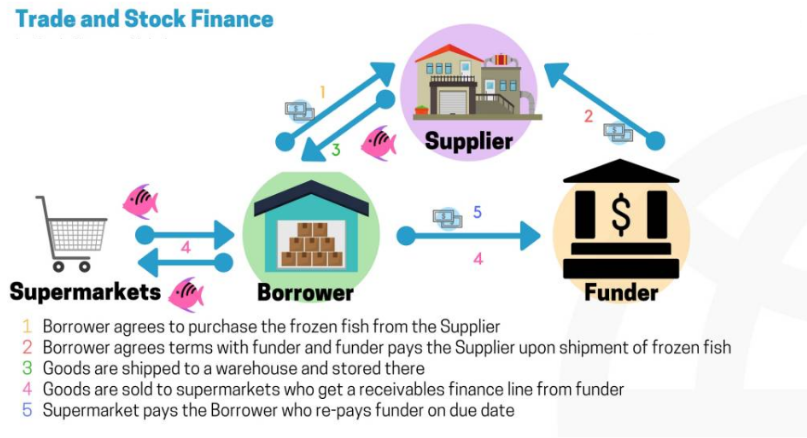

See A Worked Example Here Of How Trade Finance Can Be Used To Finance The Purchasing Of Frozen Fish From A Supplier, To Be Sold On To End Customers: